Cold-Formed Metal Buildings Construction Data

By Paul Deffenbaugh, Contributing Editor

Versatility, ease of construction, and convenience make cold-formed steel buildings excellent options for outbuildings such as equipment sheds, garages, or machine shops. But the growing barndominium market has pushed this building type in new directions, and shown how truly versatile it can be. Clean, smart residential areas combined with flexible open-span spaces make it perfectly designed to meet the needs of these consumers.

The cold-formed metal buildings market is growing and more than half of our survey respondents expect 2024 to be a good year across all market segments with about half reporting growth and only a small percentage anticipating a decline in any of the segments. For this report, we will refer to these as metal buildings, but they should not be confused with pre-engineered metal buildings (PEMB) – also called metal building systems – which use heavy red-iron as a framing system, not cold-formed steel.

Characteristics of the Cold-formed Metal Buildings Industry

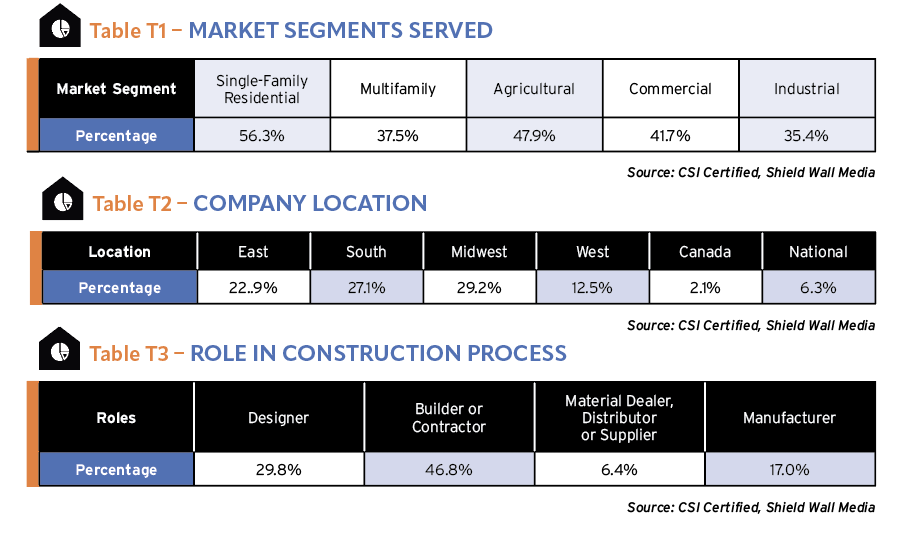

Companies engaged in metal buildings serve all the market segments across the construction industry but they are most heavily involved in single-family residential construction (56.3%) followed by agricultural (47.9%). That matches up with our general perceptions about these buildings and their uses. They fit in with single-family work and are quite popular in agricultural communities. There are far fewer companies serving the agricultural community than single-family, so it would be unlikely that these companies would serve the agricultural market at a higher percentage. T1

The commercial market (41.7%) ranks just behind agricultural in market segments served followed by a near tie between multifamily (37.5%) and industrial (35.4%).

The Construction Survey Insights (CSI) data show that the Midwest (29.2%) had the most respondents among companies engaged in metal buildings followed by the South (27.1%) and the East (22.9%). Representation from companies in the West (12.5%) was much lower. While we have been able to show breakouts by regions in other sections of this report, the lower response rate among metal building companies from the West makes that data less reliable. We also had a few survey takers reporting from Canada (2.1%) and some identified as national firms (6.3%), meaning they served more than one U.S. region. T2

Since 17% of our respondents who are engaged in metal buildings are manufacturers, the representation among national companies can be explained in part by that. The largest number of respondents were builders or contractors – those doing the actual installation work. In some circles, this portion of the supply chain is called “sell, furnish, and install,” meaning they are the point people for the connection with the buyer. We do have a few distributors (6.4%) survey takers, but in this market sector the contractors tend to get the materials directly from the manufacturer. Designers are involved in metal buildings, of course, but since most of these buildings are off-the-shelf solutions, the involvement of designers is more limited, and may be associated with the manufacturers or design-build construction firms. The rise of the barndominium market does bring in more designer involvement. T3

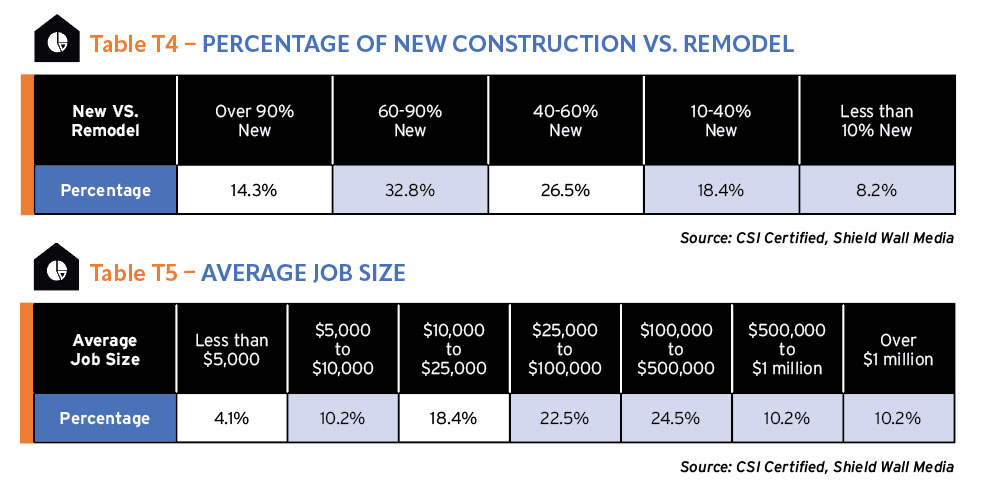

Nearly half (47.1%) of the respondents engaged in the metal building sector say more than 60% of their construction is newwith 14.3% of the total saying almost all their work (more than 90%) is new. About a quarter of the respondents (26.5%) tell us their work is nearly evenly split between new and remodeling. And about a quarter (26.6%) say less than 40% of their work is new. Only 8.2% say less than 10% is new construction. Little remodeling work is done on these kinds of buildings other than maintenance and repair, but companies in this sector also have other services they provide, especially in rural areas where specializing is much more difficult. T4

Slightly over half (55.2%) of respondents engaged in metal buildings say their average job size is less than $100,000, and a third (32.7%) say it’s less than $25,000. The number claiming average job size under $5,000 (4.1%) likely do mostly maintenance and repair work with some small retrofit projects. T5

The sweet spot for barndominiums is likely in the $100,000 to $500,000 range and that’s where about a quarter of our respondents (24.5%) report their average job size lands. The large jobs, those over $500,000, certainly include more work than just the metal building so those projects likely include a metal building as part of the scope.

Projected Industry Growth

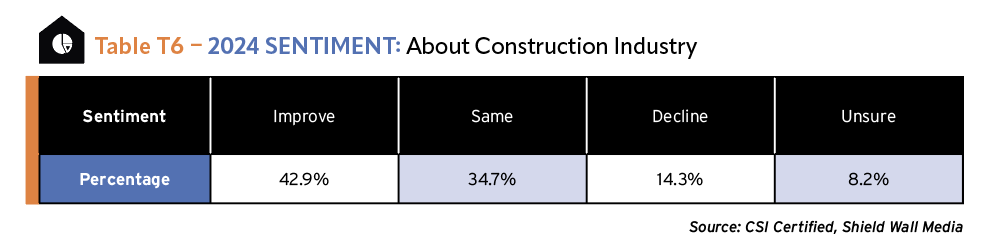

The companies engaged in metal buildings are actually pretty bullish on the prospects for the overall construction market in 2024 compared to other sectors. 42.9% of them think the construction market will improve and 34.7% expect it to stay the same. With Dodge Data and Analytics forecasting a 7% increase in commercial and construction work in 2024, you might expect there to be even more optimism, but the National Association of Home Builders (NAHB) has downplayed growth in residential, especially multifamily, where NAHB expects starts will plummet 19.7%. Add remodeling activity as forecast by the Remodeling Futures Program at Joint Center for Housing Studies, and you find another 6.5% decline in construction activity, so maybe the 42.9% of respondents who think the industry will improve are very optimistic. T6

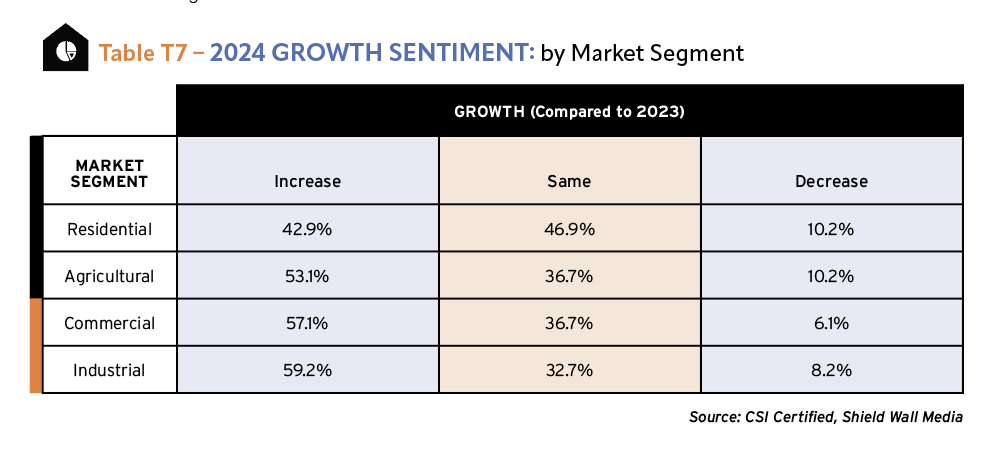

When you look at where companies engaged in metal buildings think the growth in the market will come from in 2024, the finger points clearly at the industrial segment, where 59.2% of respondents anticipate an increase in the market. But there is positive sentiment in the agricultural market with 53.1% of survey takers anticipating an increase in activity as well as the commercial market where 57.1% of respondents look for a better market. T7

Only in the residential market do less than half the companies engaged in metal buildings say the market will increase with 42.9% predicting an uptick while 46.9% of respondents think this market segment will hold the same. The variation among survey takers who think any of these market segments will decline is relatively small. Between 6% and 10% of companies engaged in metal buildings believe these segment will prove to be poorer markets in 2024 than they were in 2023.

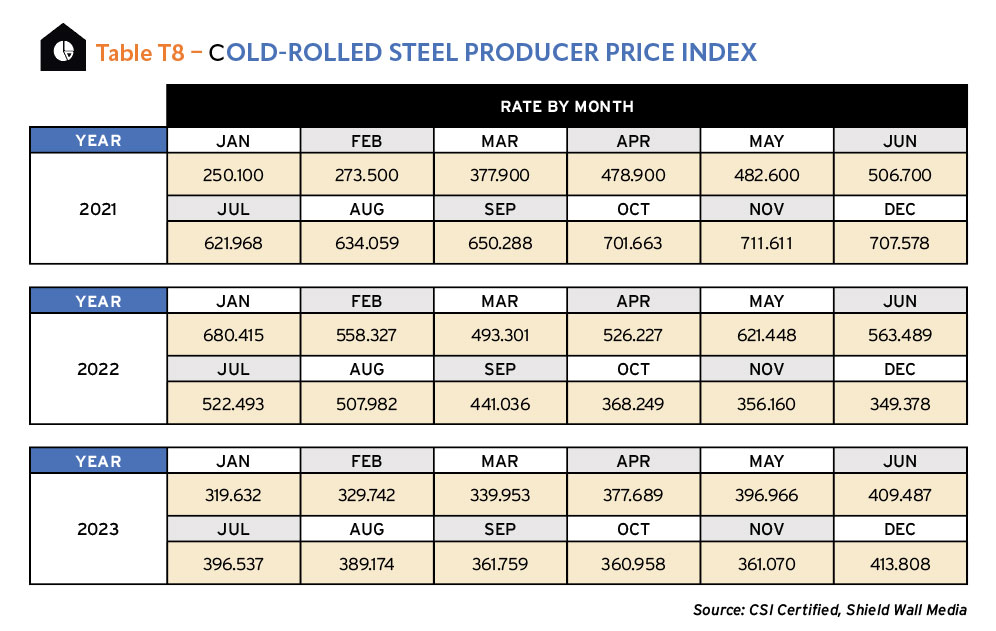

In spite of all the disruptions to the supply chain during the COVID-19 pandemic, it wasn’t until the beginning of 2021 when cold-form steel prices started to rise. Until then, the producer price index (PPI) had remained steady around 250 until the end of 2020, then it began it’s sharp increase. Based on a 1982 index that equals 100, the PPI for cold-rolled steel jumped to 711.611 in Nov. 2021 then dropped over 2022 to reach a low point of 319.632 in Jan. 2023. Since then, the price has fluctuated, rising up during the Summer, coming back down in the Fall only to see another increase at the end of 2023. As of Feb. 2024, the index sits at 454.090, which is more than an 80% increase over the Jan. 2021 PPI. T8

The PPI is a great indicator of the kinds of cost pressures everyone on the metal building supply chain is facing, which leads to more pressure on profits.

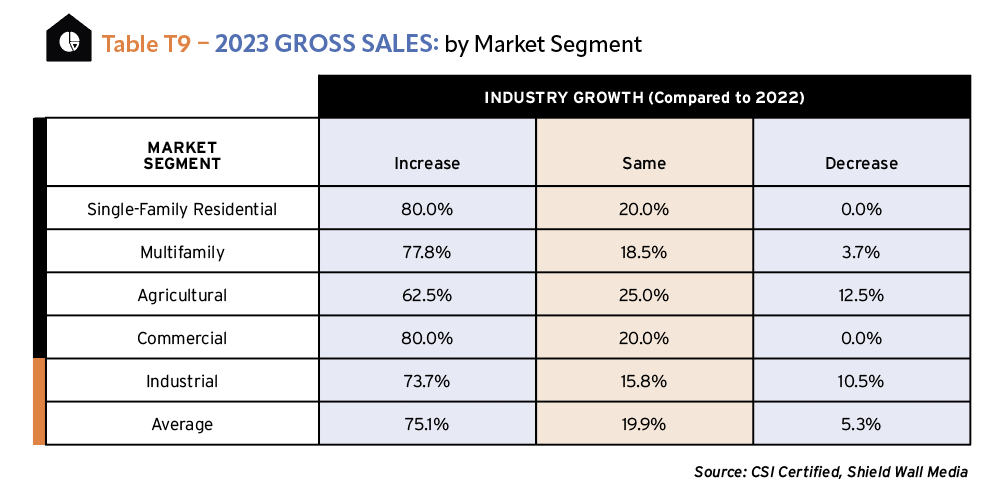

About three quarters (75.1%) of companies engaged in metal buildings saw an increase in gross sales in 2023, and roughly the same percentage of respondents report increases in each of the market segments with the exception of agricultural. Between 73% and 80% saw their gross sales increase in single-family, multifamily, commercial, and industrial market segments, but only 62.5% of survey takers saw an increase in gross sales in the agricultural market in 2023 compared to 2022. T9

Very few survey takers experienced declines, with an average across all market segments of 5.3% reporting lower gross sales. Again, agriculture was the troublesome market segment where the most respondents (12.5%) said their annual sales went down in 2023.

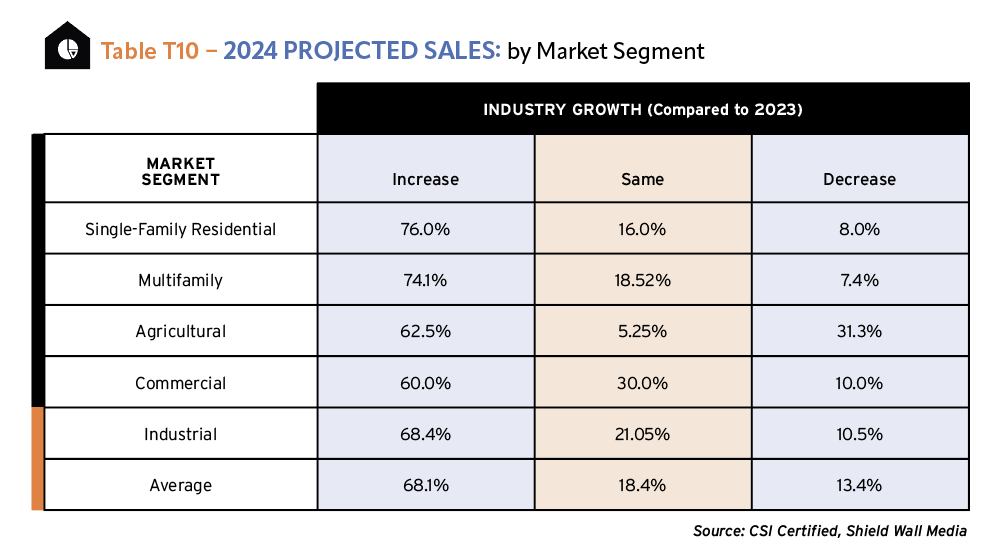

Looking to 2024, respondents were less optimistic about their company’s growth in sales in 2024 with only 68.1% of them on average expecting to see an increase while 13.4% anticipate a decline. This time, though, companies serving the commercial segment were the ones more pessimistic than the other market segments. Only 60% of them report they are planning for an increase in sales. At first glance that looks like a more negative sentiment than the other market segments until you look at which areas respondents think will decline. Overwhelmingly compared to other segments, companies serving the agricultural market expect gross sales to decline in 2024 year over year (31.3%). In fact, respondents in the agricultural market generally expect either an increase or a decline; only 5.25% think sales will remain the same. T10

The other three segments – single-family, multifamily, and industrial – all have survey-takers reporting roughly similar expectations with the residential markets having a little higher percentage who think their business will grow.

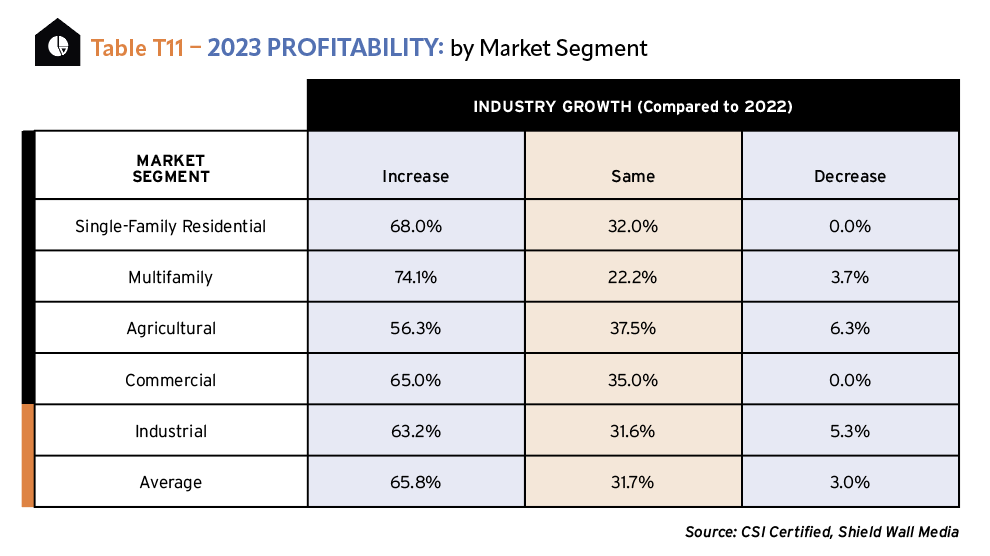

On average, 65.8% of respondents to the CSI say their profits increased in 2023 compared to 2022. That is fewer than report sales increased (75.1%) and can probably be attributed to the difficulty of controlling costs during this period of higher inflation and rising interest rates the U.S. economy has experienced. It sounds negative, so it’s important to show that sales and profits did increase or stay the same for a vast majority of our respondents in 2023 compared to 2022 and only 3% saw a decline in profitability. T11

Looking at different market segments, again agriculture respondents (56.3%) were least likely to see increased profits, and multifamily were the most likely (74.1%). Only 6.3% of metal buildings serving the agricultural market report profit declines in 2023 with 5.3% of respondents in commercial seeing declines, making it the second highest segment reporting declines.

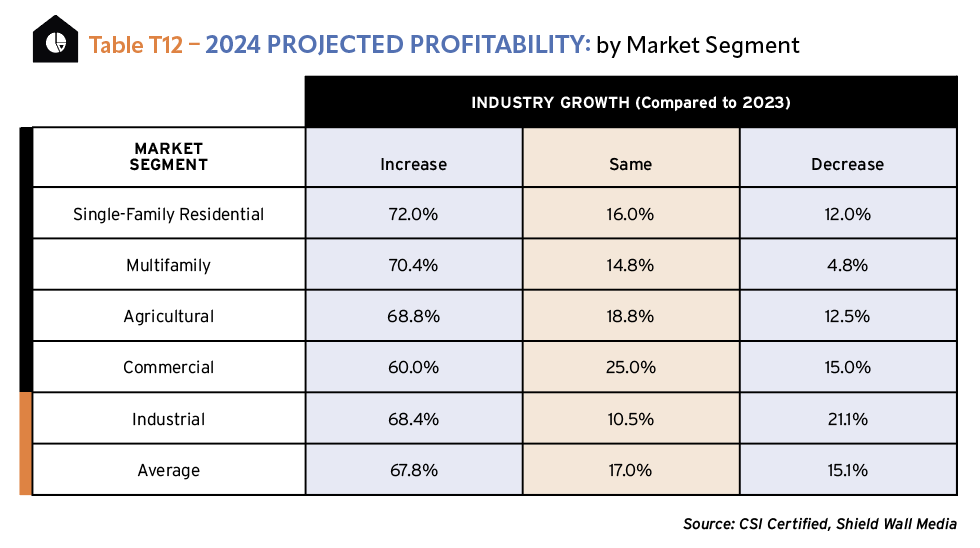

As with sales projections for 2024 among companies engaged in metal building construction, the picture of projected profitability isn’t quite as rosy as 2023’s profits.On average, 67.8% of our respondents think their profits will increase in 2024 compared to 2023 and 15.1% of respondents anticipate a profit decline. While roughly the same percentage of respondents on average report planning for increased profits, the 15.1% anticipating a decline is significantly higher than the 3% who reported a decline in 2023, and in keeping with the 13.4% who anticipate a gross sales decline in 2024.T12 & T10

Breaking out responses by market segment, survey takers were roughly equal across all segments in their anticipation of increases in profitability, declines in profitability, or profits remaining constant. The exception is the commercial market segment, where 60% of companies engaged in metal buildings who serve that market anticipate an increase compared to the roughly 70% across the other segments. And 25% of them expect profits to hold steady. Only respondents in the industrial sector expect a decline in profits that is out of line with the other segments. In that segment, 21.1% think profits will decline.

Company Size and Growth Projections

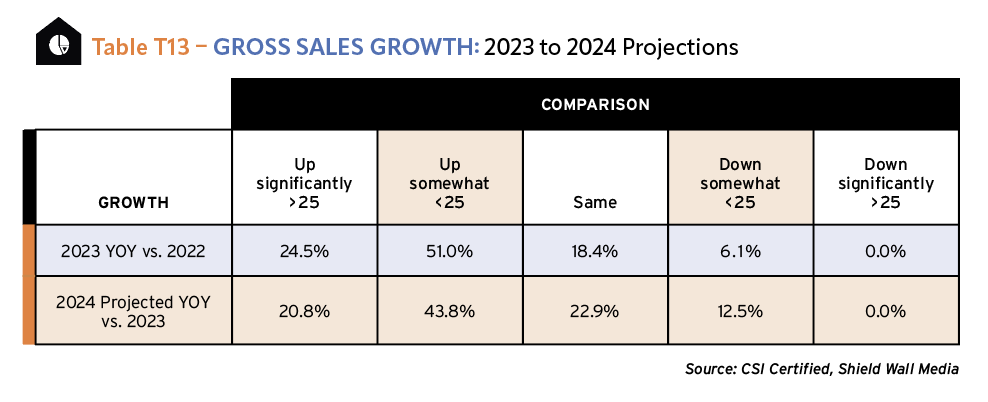

When we dig deeper into the CSI data and look more specifically at how much respondents saw sales change in 2023 compared to 2022, we get a more nuanced picture. About three quarters of companies engaged in metal buildings saw sales increase in 2023, and a third of them (24.5% of all respondents) saw sales jump more than 25%. Half of all respondents experienced sales growth of less than 25%. Just under a fifth (18.4%) of respondents say gross sales held steady in 2023. (There is some small discrepancy between these percentages and the averages across market segments in the previous graphs. Some respondents identified “other” as a market segment and were not included in the averages of that data.) T13

None of these respondents report a significant decline in year-over-year sales in 2023, but 6.1% do report a decline of less than 25%.

Placing that previous actual performance against the anticipated performance of 2024, shows that respondents on the whole are not very optimistic about sales growth this year. A total of 64.6% believe sales will increase, with 20.8% saying they will jump significantly. Slightly more respondents (22.9%) report their gross sales will stay the same compared to what they experienced last year. But nearly double the number of survey takers say sales will decline in 2024 compared to 2023. Only 6.1% of survey takers say sales dropped in 2023.

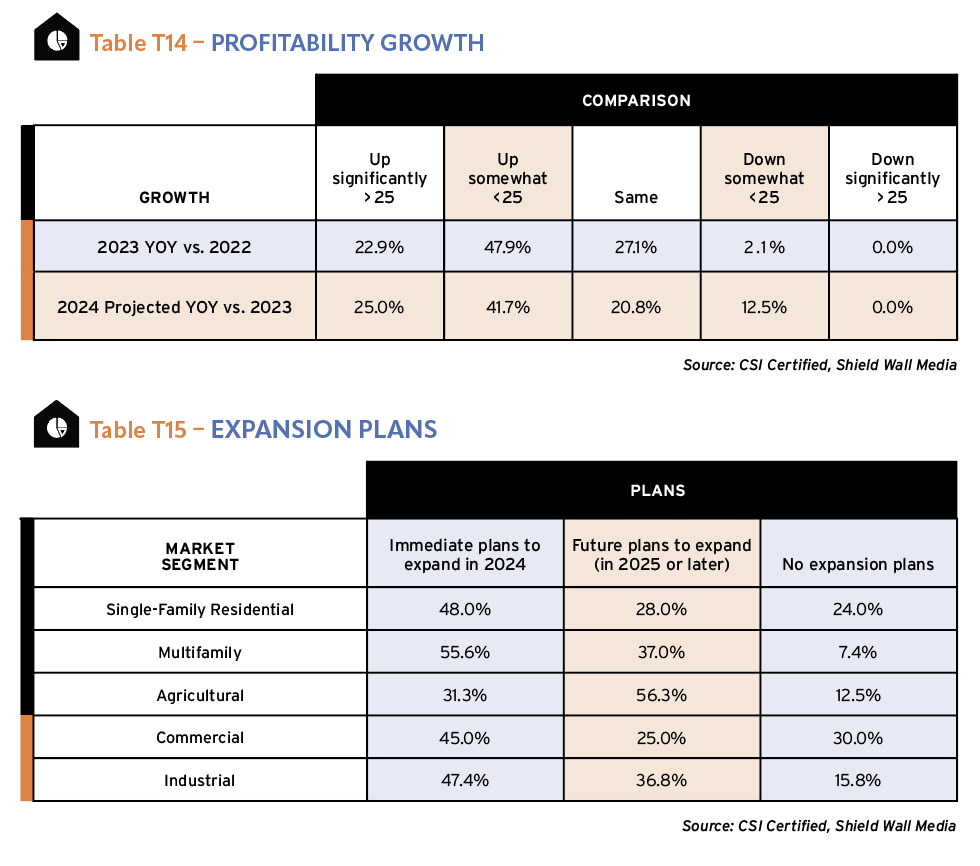

If you compare the profit performance of companies engaged in metal buildings in 2023 to their sales performance, you actually get a pretty nice picture. Only 2.1% of companies reported a decline in profits in 2023 and 22.9% say they were greater than 25%. Compare that to the 6.1% who report sales declined. Only 18.4% say sales stayed even in 2023, but 27.1% report profits held steady. It’s not all rosy, though, because 75.5% of respondents report sales increased in 2023, and only 70.8% report profits increasing. Given the difficulty in controlling costs in 2023, those percentages are a strong commendation of the strength of companies engaged in metal buildings. T14

When projecting profit performance for 2024, these respondents matched the slightly more pessimistic view they had about gross sales. There’s a greater likelihood profits will decline in 2024, say 12.5% of survey takers, which is the same as the percentage who said sales would drop. Still, two thirds (66.7%) think profits will increase in 2024, and 25% think they will jump significantly. On the upper end, among those who see big increases, our respondents were more likely to see a larger jump in profits than they were sales (25% vs. 20.8%) in 2024.

Future Opportunities and Challenges

Remembering back to the last section covering the garage, shed, and carport companies when there was little interest in expansion, it’s exciting to see relatively robust enthusiasm for expansion among companies engaged in metal buildings. It’s especially interesting since the two sectors have many things in common. Perhaps it’s the rise of the barndominium market that has respondents feeling expansive.

In every segment, respondents are more likely to have immediate expansion plans than delayed plans or no plans with the exception of the agricultural market. In that segment, 31.3% of our respondents say they have plans to expand in 2024, but 56.3% intend to put expansion off a bit longer. Only 12.5% of respondents serving the agricultural market suggest they have no plans to expand. T15

About half of the survey takers in the other markets, though, say they plan to expand their business in 2024. Among those with no plans, though, the bag is a bit more mixed. Single-family (24%) and commercial (30%) are least likely to report expansion plans while industrial (15.8%) and multifamily (7.4%) say no expansion plans. The companies serving the multifamily market were the least likely to have no expansion plans and the most likely to plan to expand in 2024 (55.6%).

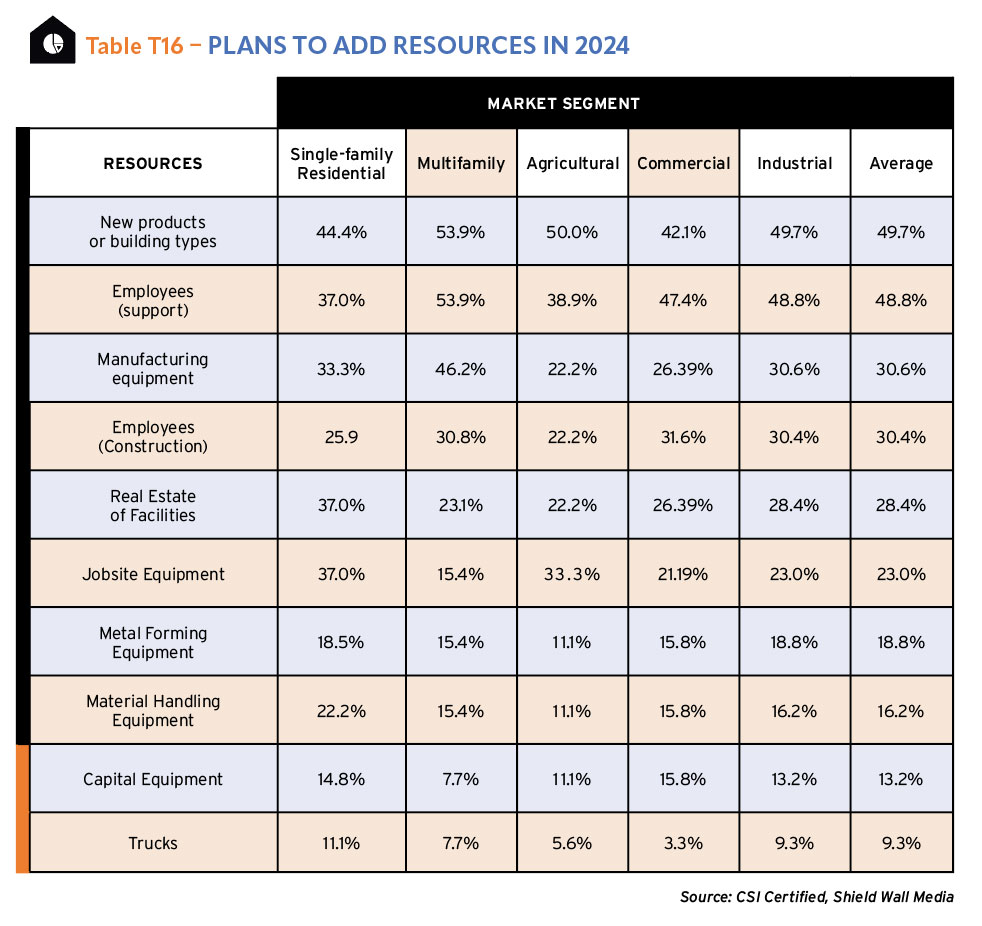

As with all the other sectors in the CSI report, companies looking to add resources are most likely to add new products or building types with an average of 49.7% of survey takers saying that’s a resource they will pursue. Coming in second is adding support employees. 48.8% of our respondents look to add people in the office who can help people in the field. That could be administrative people but it could also be a desire to add sales people to help grow the business. T16

After those two options, the percentages of respondents looking to specific resources drops below 4%. Manufacturing equipment (30.6%) is the next resource respondents spotlight, which rises more highly because of the heavy involvement of manufacturers in the survey. Contractors are the largest component of survey respondents, and they have been complaining for years about the skilled labor shortage. Only 30.4% of companies engaged in metal building construction are aiming to add field employees. Two potential reasons are that they have given up trying to add this resource or they have shifted business to rely more on subcontractors and don’t need to hire field people. T16

The other four resources that about 30% of our respondents say they plan to add are real estate or facilities (28.4%), jobsite equipment (30.2%), metal forming equipment (18.8%), and material handling equipment (16.2%). Three of those resources are designed to make work on the jobsite more efficient and require less labor, which feels like a work-around to the skilled labor shortage. Capital equipment (13.2%) and trucks (9.3%) round out the list of top resources companies engaged in metal buildings plan to add.

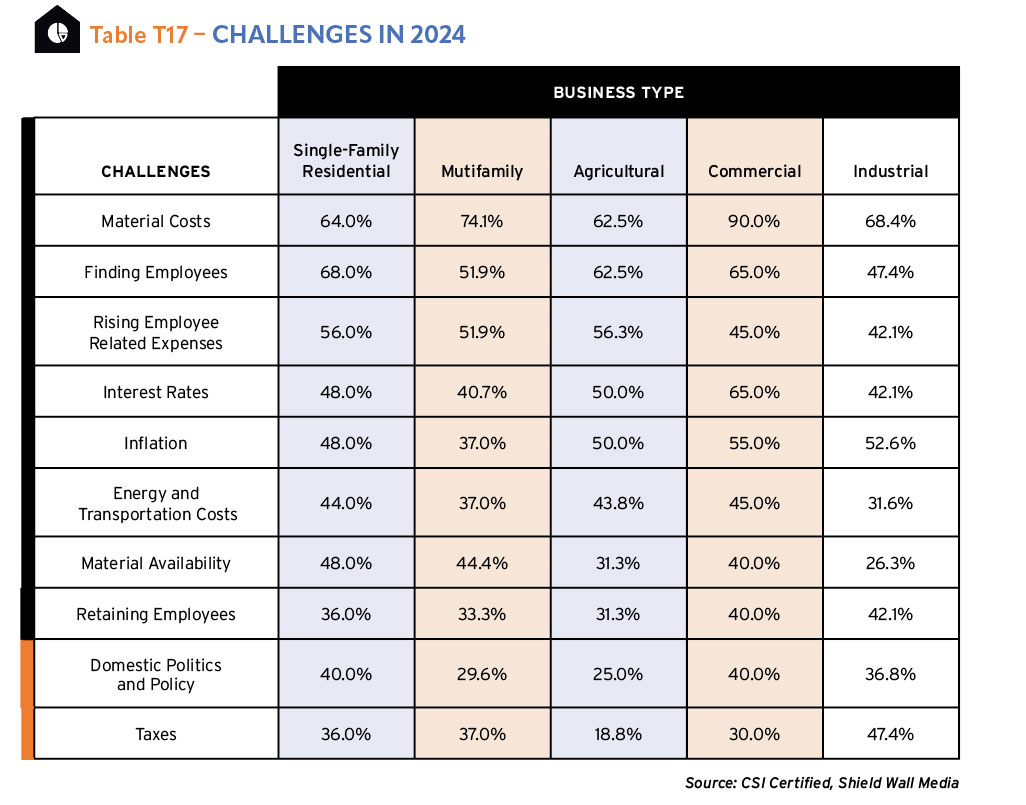

Looking at the challenges CSI respondents face in 2024, it’s interesting that rising costs and increasing regulations are defining elements of their ability to manage their businesses. As was seen earlier in the spiking prices for cold-rolled steel, the cost of materials has become a significant challenge, and on average 71.8% of our respondents point to it as a difficulty they’re facing this year. That makes it the challenge mostly commonly selected among survey takers. T17

Other cost-related challenges are rising employee-related expenses (50.2%), interest rates (49.2%), inflation (48.5%), cost of energy and transportation (40.3%), and taxes (33.8%). Our respondents noted all of these as challenges they needed to face in 2024. There was a tangentially related item – domestic politics and policy – that 34.3% of respondents said would be a challenge. Reading between the lines is difficult, but this could be concerns about increased regulation or worries about heightened political strife during a presidential election year. It could be concerns at the federal, state, or local level. But because the construction industry is highly regulated, any issues related to regulation – code, environment, or fiscal – gets greater attention and more likely thought of as a challenge.

The challenges not mentioned so far are the issues of finding employees (58.9%) and retaining employees (36.5%). As was mentioned above when discussing what resources respondents planned to add, support employees was second on the list. Here the second most cited challenge is finding employees. It has been the bane of the construction industry for more than two decades, but now it has a new twist. Rising wages (see rising employee-related expenses) in other industries are creating new competition for workers – both support and field. That makes it even more essential, as the survey takers have noted, that they have to retain the employees they have.

Check out the whole Construction Survey Annual & Market Data 2024!